Budget Cuts, Digital Growth, and Content Collaboration: Key Takeaways from Hong Kong’s Latest Ad Spend Report

The final report on advertising spending projection 2025 by The Hong Kong Advertisers Association, in partnership with NielsenIQ, is out and here’s what you need to know about it.

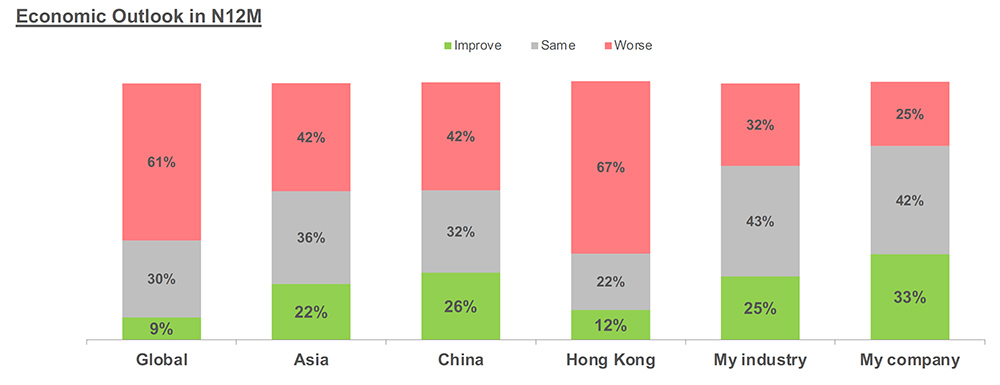

Market pessimism

With challenges and uncertainties looming over Hong Kong’s economy, 67% of marketers hold a negative view on the upcoming 12 months economic future. In contrast, only 12% feel positive. Key reasons for feeling pessimistic are worries over local and global economic conditions, the weakening of domestic spending and a shift to overseas or Mainland spending.

According to NIQ Cross-border Syndicated Study (Apr 2025), 75% of Hong Kongers* surveyed have visited Shenzhen, one of the most popular destinations for shopping and dining, within the last three months, holding steady from last year. However, frequency has increased slightly from 1.5 times to 1.6 times per month.

There is still a silver-lining

The report however identified five business opportunities, which marketers might consider leveraging as we make sense of the new economy: Changing population mix, Greater Bay Area development, Mega events, Tourism rebound and The prevalence of Artificial Intelligence (AI). With more tourists and customers coming, made possible by events and the expansion of Individual Visit Scheme cities, as well as an influx of immigrants through various talent acquisition schemes, it is up to brands to adapt to a new set of consumers, where AI could be a tool worth utilizing.

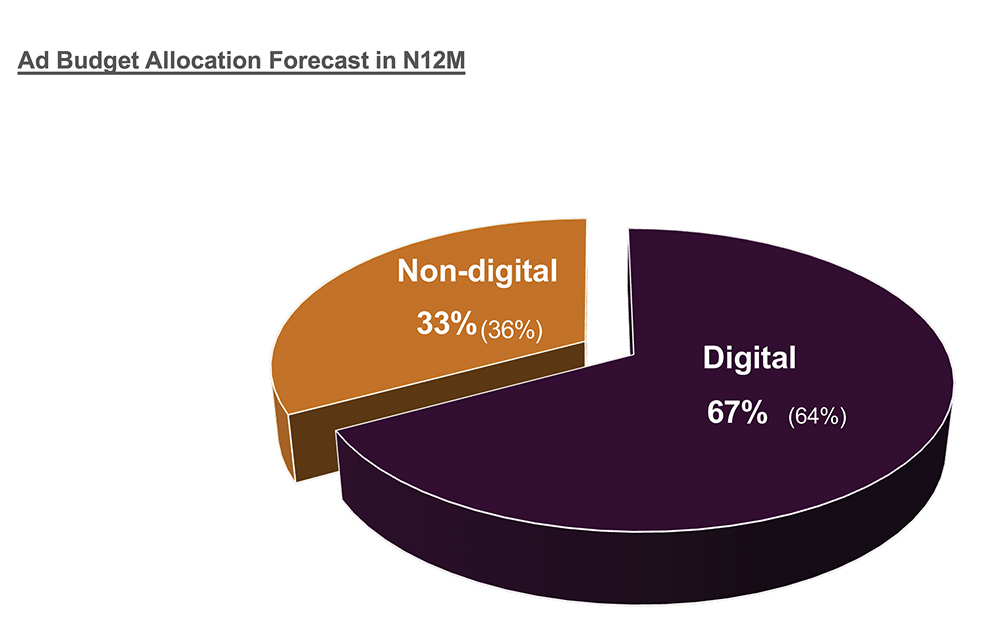

Not less, but different: A shift of ad spend to digital

While most industry categories either remained flat or decreased in ad spending, four industries are anticipated to have business growth, namely Pharmaceutical and Healthcare, Travel and Tourism Services, E-Retailers and E-Commerce, as well as Insurance.

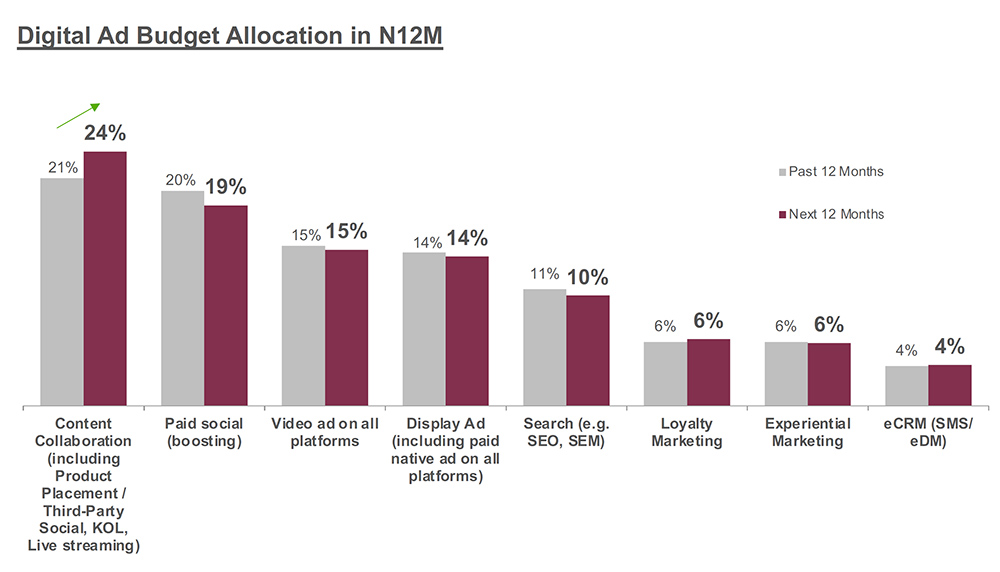

On the other hand, 42% of marketers expect to spend less overall on advertising while only 19% expect to see an increase. However, 36% of marketers expect to increase their digital advertising budget, hence less a decrease and more like a shift in investment in channels (of the budget planned for the next 12 months, 67% of them are expected to allocate in digital advertising). This might be related to the perennial marketing challenge of difficulty in calculating ROI and asserting how (traditional) advertising boosts one’s purchase intention.

Not all digital channels are emphasized equal either – with content collaboration, including product placement, KOL and live streaming, seeing an YoY increment in spending from 21% to 24%. Other categories such as paid social, video, display ads and search remain either flat or see slight decrease.

What’s on Marketers’ agenda today?

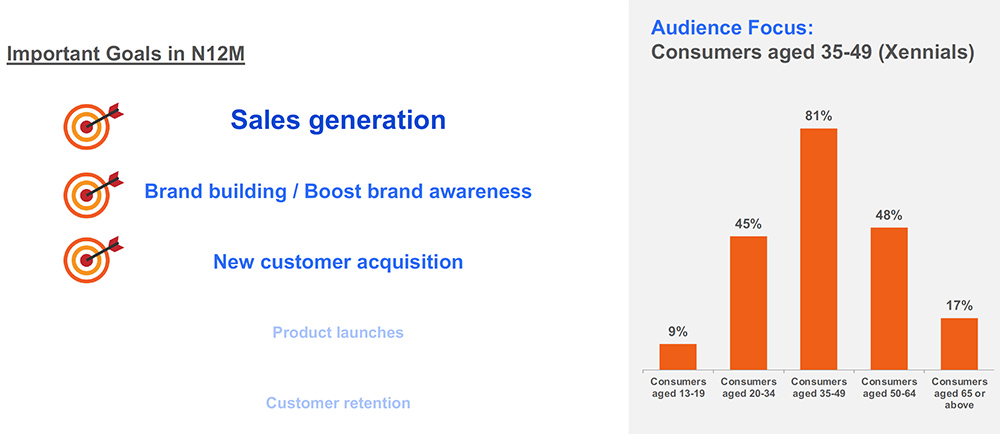

Given the economy and pressure to deliver, sales generation remains the most key goal in the next 12 months, with brand building/awareness boosting and new customer acquisition following.

Among audience focus, Xennials (customers aged between 35 and 49) has taken over the spotlight for their blend of financial resources and pursuit of sophistication. With 81% of respondent marketers going for Xennials, this ocean is more burgundy than red with competition cut-throat. To succeed, one might be prudent to consider leveraging partners that can reach a wide audience while staying budget-friendly to go at it together. Platforms and partners that have a strong proven track record in engaging Xennials should be high on any marketers’ coffee chat list.

More facts to consider

Yahoo is the #1 internet property in Hong Kong, reaching over 5 million monthly unique visitors (80% reach) and commanding an average of 30 minutes of their attention*. Among them, 88% are aged 25 or above. According to GWI, Yahoo users come from higher-income households compared to the general public, suggesting stronger purchasing power. Meanwhile, Yahoo News has surpassed other leading digital news outlets in Hong Kong, achieving a 68% trust score according to the Reuters Institute Digital News Report 2025. With the trusted, brand-safe environment, we are uniquely positioned to collaborate with brands on content partnerships that foster meaningful connections and attract real customers.

When our content is live, people pay attention – let’s make your brand heard.

Source: *Comscore Media Metrix® Multi-Platform, Total Audience, Desktop 6+ and Total Mobile 15+, Top 100 Properties, Total Unique Visitors and % Reach, Custom 12 Month Average (Jul-2024 to Jun-2025), Hong Kong

More Insights

Ready to Start?

Hey, So Are We.

Our sales team can help you truly connect to audiences with unified solutions scaled for growth.

Get in Touch