Yahoo Finance Hong Kong Unveils Emerging Investment Trends: Investors Allocate 30% of Assets to Financial Products as Gen Z and Millennials Eye AI and US Stocks

Yahoo Finance in Hong Kong has unveiled the findings of its latest Finance Survey Report, offering key insights into the investment behaviors of Hong Kong residents. The survey highlights the emergence of a new era of mass participation in investing, with trends showing stark differences across age groups and income levels. These findings are critical in understanding the shifting landscape of investment preferences, risk tolerance, and retirement planning in Hong Kong, providing valuable insights for both novice and seasoned investors.

Investors Allocate 30% of Assets to Financial Products

The survey reveals that over half of Hong Kong consumers are engaged in investing, with an average investment experience of 7.8 years. Many investors begin their journey in their 30s, driven by the motivation to accumulate wealth. On average, 30% of their total assets are allocated to financial products, equivalent to 19% of disposable Income, with monthly spending on investments averaging HK$387,000. Stocks remain the most popular asset class, with younger investors showing a pronounced interest in overseas markets, particularly in the United States.

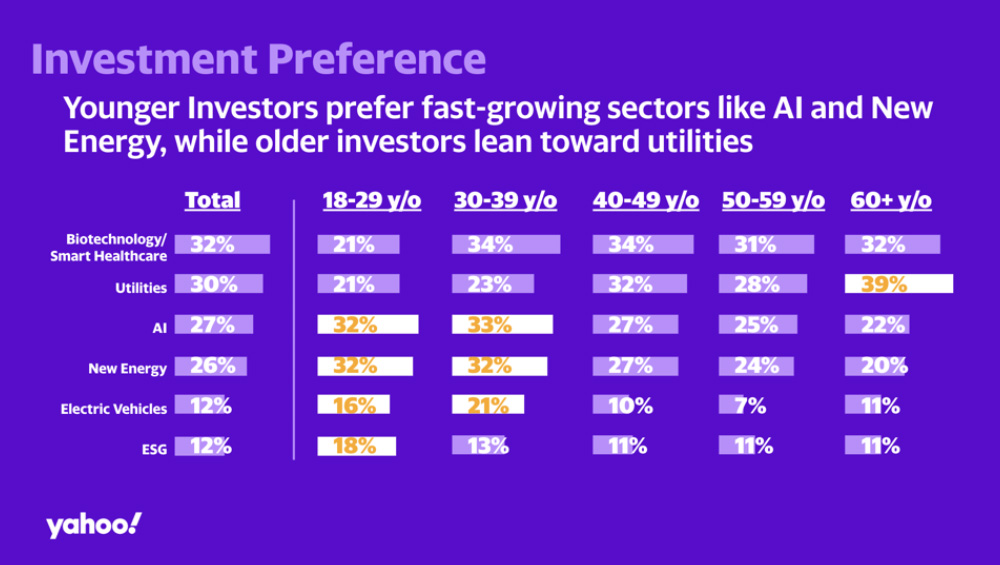

Gen Z Leads the Charge in AI, New Energy, and US Stocks

Notably, Gen Z investors demonstrate a strong preference for innovative sectors like AI (32%) and new energy (32%), while also displaying a growing interest in overseas equities, especially in the US. These younger investors are generally more open to risk and possess higher return-on-investment (ROI) expectations compared to their older counterparts.

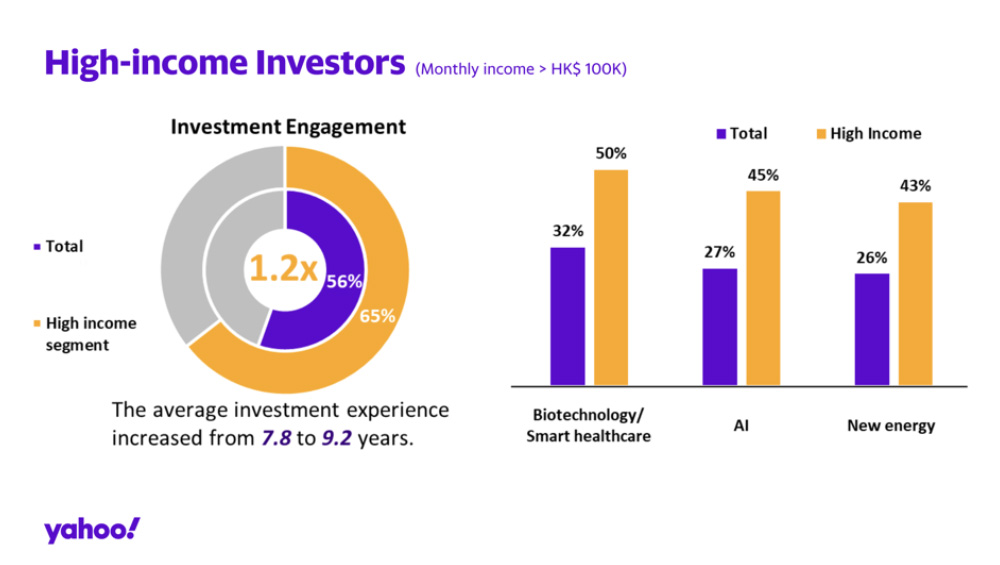

High-Income Investors Show a Broader Appetite for Innovation and Growth

High-income investors, earning over HKD 100,000 monthly, actively engage in diverse sectors like biotechnology (50%), artificial intelligence (AI) (45%), and new energy (43%). With an average investment experience of 9.2 years, they demonstrate a high level of commitment, with 65% reporting strong investment engagement. Notably, they start investing significantly earlier—often during their school years—beginning their journeys 2.1 times sooner than average investors. By diversifying their investments across multiple high-potential industries, these investors position themselves to take advantage of emerging trends that offer substantial returns

Retirement Planning Starts Early, with HK$4.2M Set Aside for the Future

In terms of retirement planning, most Hong Kong residents begin preparing for retirement before their 40s, with many targeting retirement in their 60s. On average, individuals are setting aside approximately HK$4.2 million to fund their post-retirement life. For those who have already retired, cash savings remain the primary source of income. Middle-aged investors who are more prepared for retirement also tend to be more actively engaged in various investment activities, demonstrating a link between robust financial planning and proactive investment strategies.

ESG Awareness Grows, with Younger Investors Driving Interest in Responsible Investing

The survey also highlights growing awareness of Environmental, Social, and Governance (ESG) factors, with more than half of respondents familiar with the concept. However, most admit to only a basic understanding of ESG-related financial products. Interest is especially strong among those aged 30 to 40, who are more likely to engage with these investment options.

Notably, individuals under 40 are increasingly aware of ESG principles, particularly favoring Sustainable Development Goals (SDGs) such as Climate Action, Good Health and Well-Being, and Affordable and Clean Energy. Additionally, more than 50% of respondents reported a heightened perception of brands that prioritize ESG goals, indicating a significant shift towards responsible investing driven by younger generations.

Yahoo Finance: Empowering Investors with Insights, Knowledge, and Real-Time Data

As these trends unfold, Yahoo Finance in Hong Kong is committed to empowering investors at all levels of their financial journey. Yahoo Finance offers the insights, knowledge, and tools necessary for making informed investment decisions. Reaching 1.9 million users, Yahoo Finance in Hong Kong ranks as the #2 finance news platform in the region.

Globally, Yahoo Finance engages over 150 million users each month, representing an audience with more than $20 trillion in investable assets. We provide high-quality, real-time market data, breaking news, and comprehensive analysis across desktop, mobile, and streaming platforms, ensuring that investors have access to the critical information needed to achieve financial independence.

For further information about the Yahoo Hong Kong Finance Survey Report, please contact us at ad.enquiry.hk@yahooinc.com.

More Insights

Ready to Start?

Hey, So Are We.

Our sales team can help you truly connect to audiences with unified solutions scaled for growth.

Get in Touch